Budget 2025-26: New Tax Slab – Will It Help or Hurt you?

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduces major tax relief, infrastructure expansion, and economic growth policies. This budget aims to increase disposable income, boost investment, and accelerate development.

Topics Covered

1. Income Tax Reforms & Updated Tax Slabs

Key Tax Announcements

✔ No tax on income up to ₹12,75,000 (including the ₹75,000 standard deduction) under the new tax regime.

✔ Basic Exemption Limit: ₹4 lakh (Income up to this limit is completely tax-free).

✔ Standard Deduction: ₹75,000 for salaried individuals and pensioners.

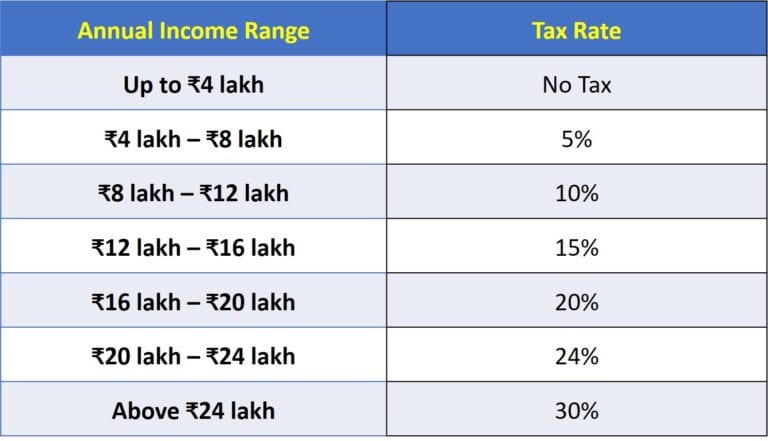

New Income Tax Slabs (New Tax Regime) for FY 2025-26

2. Tax Calculation Example

Example: Salaried Individual Earning: ₹13,00,000 (Annually)

1. Salary = ₹13,00,000

2. Standard Deduction = ₹75,000

3. Taxable Income = ₹12,25,000

Tax Calculation Breakdown

1. Tax Applicability Under the New Regime

• For salaried individuals earning up to ₹12,75,000 (including the ₹75,000 standard deduction), no tax is payable under the new tax regime.

• This is because of the government’s rebate on income up to ₹12,75,000.

• However, this rebate excludes capital gains and other additional sources of income.

2. Tax Applicability for Income Above ₹12.75 Lakh

• If your salaried income exceeds ₹12,75,000, even by ₹1, you will not be eligible for the tax rebate.

• Tax will be applicable as per the slab mentioned above.

• The first ₹4,00,000 of your income remains tax-free, but tax will be levied on income above this limit.

Example 1: Marginal Relief on ₹12.75 Lakh+ Income

• Let’s say Manish earns ₹12.75 lakh per year as a salaried employee. Due to available tax rebates and standard deductions, his effective tax liability is ₹0, meaning he doesn’t have to pay any income tax.

• Now, consider Vikas who earns just ₹1,000 more (₹12.76 lakh) than Manish. Without adjustments, he would suddenly owe ₹62,500 in tax, which seems unfair for just ₹1,000 extra income.

• To prevent this, the government penalizes a small amount and adjusts Vikas’s taxable income back to ₹12.75 lakh. applies a marginal relief system, ensuring tax is levied only on the excess income beyond ₹12.75 lahks, rather than applying full tax slabs immediately.

How Marginal Relief Works:

• Penalty Tax Formula: (Your Income – ₹12,75,000)

• You pay tax only on the extra amount above ₹12.75 lakh, not the full income.

• This relief applies until the penalty amount and regular tax slab amount will equal (~₹13.38 lakh); beyond that, regular tax slabs apply.

• income: ₹12,76,000 → Tax Payable: ₹1,000

• Income: ₹13,00,000 → Tax Payable: ₹25,000

• Income: ₹13,38,750 → Tax Payable: ₹63,750 (Full slab tax applies beyond this point)

• ✅ Health & Education Cess @ 4% is charged separately on total tax.

This system ensures a smooth transition into the tax-paying bracket, preventing a sudden high tax burden for those earning slightly above ₹12.75 lakh.

Example 2: Tax Calculation for ₹18 Lakh Income

• Income: ₹18,00,000

• Standard Deduction: ₹75,000

• Taxable Income: ₹17,25,000

• Tax Payable (as per slab rates): ₹1,45,000

• Health & Education Cess (4% on ₹1,45,000): ₹5,800

• Total Tax Payable: ₹1,50,800

• 📌 Health & Education Cess is levied separately at 4% of the total tax amount.

Calculate Your Taxes Instantly!

Use the Tax Calculator to compute your tax liability instantly. Click here to check how much tax you need to pay!

3. Tax Applicability on Capital Gains Income

If you earn income from capital gains, such as:

• Stock market investments

• Mutual funds

• Property sales

The following taxes may apply based on your gains:

• Short-Term Capital Gains (STCG)

• Long-Term Capital Gains (LTCG)

• Both STCG and LTCG, if you have both types of gains

These taxes apply even if your total salaried income is below ₹12,75,000.

Example:

If your salaried income is ₹10,00,000 and you earn ₹25,000 from capital gains (e.g., from stocks):

✔ No tax on ₹10,00,000 salaried income due to the rebate up to ₹12,75,000.

✖ Tax is payable on ₹25,000 capital gains as per applicable STCG and LTCG tax rates.

4. Benefit & Drawback

• Benefit: The tax relief will put more disposable income in the hands of the middle class, stimulating demand in various consumer sectors.

• Drawback: The old tax regime remains unchanged, offering no new benefits or changes for those who opt for it.

3. Infrastructure Development & Urban Growth

✔ ₹12 lakh crore allocated for roads, railways, and metro projects.

✔ Expansion of Smart Cities Initiative (25 new smart cities).

• Capital Expenditure Boost: A 20% increase in capital expenditure is allocated for infrastructure projects, focusing on highways, railways, and metro developments.

• Smart Cities Expansion: Plans to develop 25 new smart cities to promote sustainable urban growth.

Benefit:

This increased expenditure will lead to job creation and a demand boost in the construction and real estate sectors.

Impact on Stocks:

• Stocks to benefit: Larsen & Toubro (L&T), UltraTech Cement, DLF Ltd, Godrej Properties.

4. Agriculture and Rural Development

✔ Interest-free loans for small farmers.

✔ Subsidies for fertilizers & irrigation projects.

• Farm Credit Limit Increased: The government has raised the credit limit for farmers to provide better access to finance for agricultural activities.

• Climate-Resilient Crops Promotion: The government launched a national mission to promote high-yield, climate-resilient crops.

Benefit:

These measures will increase rural income and boost demand for agricultural equipment and services.

Impact on Stocks:

• Stocks to benefit: Mahindra & Mahindra, Escorts Ltd, BASF India.

5. Technology & Digital India

✔ Tax benefits for AI & semiconductor startups.

✔ ₹20,000 crore allocated for 5G expansion.

• Tax Incentives for Tech Startups: The government will provide tax exemptions and incentives to AI and semiconductor startups, encouraging innovation and attracting global investments in these high-potential sectors.

• Boost to 5G Infrastructure: A ₹20,000 crore allocation has been made for expanding 5G networks across the country, aimed at enhancing connectivity and supporting the digital economy.

Benefit:

These measures will promote innovation in AI and semiconductor technologies, while also expanding digital connectivity through 5G, which will stimulate growth in the tech and telecom sectors.

Impact on Stocks:

• Stocks to benefit from AI and semiconductor growth: Tata Elxsi, L&T Technology Services, Mindtree.

• Stocks to benefit from 5G expansion: Bharti Airtel, Reliance Industries, Vodafone Idea.

6. Impact on the Stock Market

The stock market reacted positively to tax cuts and infrastructure spending. Here’s how different sectors may perform:

1. Stocks Likely to Rise:

• Insurance Stocks:

The government has allowed 100% FDI in the insurance sector, encouraging foreign investment.

Stocks to rise: ICICI Prudential Life, HDFC Life, SBI Life Insurance.

• Infrastructure Stocks:

The infrastructure spending boost will positively impact construction and real estate companies.

Stocks to rise: Larsen & Toubro, UltraTech Cement, DLF Ltd.

• FMCG Stocks:

Higher disposable income will likely result in increased demand for everyday goods.

Stocks to rise: Hindustan Unilever, Dabur India, Britannia Industries.

• Automobile Stocks:

The tax relief for the middle class is likely to increase automobile sales.

Stocks to rise: Maruti Suzuki, Tata Motors, Hero MotoCorp.

2. Stocks Likely to Drop:

• Banking and Financial Stocks:

Despite a reduced fiscal deficit, the financial sector might face pressure due to stricter lending regulations.

Stocks to drop: State Bank of India, HDFC Bank, ICICI Bank.

• Real Estate Stocks:

Rising land prices may negatively affect the affordability of housing and urban development.

Stocks to drop: Indiabulls Real Estate, Oberoi Realty, Brigade Enterprises.

7. Benefits & Challenges of Budget 2025-26

Benefits

✔ Middle-class tax savings = More disposable income.

✔ Boost to infrastructure = Job creation & economic growth.

✔ Startup-friendly policies = Support for tech innovation.

Challenges

✖ Increased taxation on high-income groups.

✖ Short-term stock market volatility.

8. Disclaimer

The stock names and financial information provided in this blog are for educational purposes only. The predictions regarding stock performance (whether it will rise or fall) are based on current market trends and budget announcements. However, stock market investments involve inherent risks, and actual performance may differ. The stock market is influenced by multiple factors, such as external global events.

Past performance is not indicative of future results.

This blog does not guarantee any investment outcomes or provide personalized investment advice. Before you start, make sure you understand the Stock Market Basics and think about your financial goals, Always consult with a certified financial advisor before making any investment or tax-related decisions.

The rise or fall of stock prices is subject to various market dynamics and will not be directly correlated with the opinions or information presented here.

9. Conclusion

The Union Budget 2025-26 provides major tax relief for middle-class individuals while boosting economic growth through infrastructure investments.

• Salaried individuals & MSMEs benefit the most.

• Infrastructure, banking, and technology sectors will likely grow.

• Luxury goods and tobacco industries may face a decline.

Overall, this budget is growth-oriented and aims to strengthen India’s position as a $5 trillion economy.

10. FAQs on Budget 2025-26

Who benefits the most from the new tax slabs?

Salaried individuals earning up to ₹12,75,000 benefit the most as they pay zero tax.

The new tax slabs provide significant relief to middle-income earners. Individuals in this bracket will see a reduction in their overall tax burden, enhancing disposable income.

Are there any new schemes for MSMEs?

Yes, the government has introduced low-interest business loans for MSMEs.

These loans aim to provide easier access to capital, enabling MSMEs to grow and create more jobs. There are also enhanced digital tools to improve efficiency and competitiveness in the sector. The government is focusing on making MSMEs more resilient by offering financial support and market access.

How will the tax changes impact the middle class?

The government has provided significant relief by increasing the income tax exemption limit to ₹12 lakh under the new tax regime. This will leave more money in the hands of middle-class individuals, boosting spending and improving their financial situation.

Which sectors are most likely to benefit from the budget?

Sectors such as infrastructure, insurance, FMCG, and agriculture are likely to benefit from the budget’s focus on increased government spending and reforms aimed at stimulating growth in these areas.

Will the infrastructure boost lead to growth in the stock market?

Yes, the government’s increased investment in infrastructure, including railways, highways, and smart cities, is expected to benefit construction and real estate stocks such as Larsen & Toubro, UltraTech Cement, and DLF Ltd.

What impact will the budget have on the agriculture sector?

The budget’s provisions, such as an increased credit limit for farmers and the promotion of climate-resilient crops, will likely boost agricultural production and income, benefiting agriculture-related stocks like Mahindra & Mahindra and BASF India.

How will the tax regime affect the stock market?

The new tax regime with its higher exemption limit may lead to increased consumption, particularly benefiting FMCG and automobile stocks. It may also fuel demand in sectors like real estate and retail.

Which stocks could face challenges due to the budget?

Banking and real estate stocks may face challenges due to higher regulatory requirements and rising land prices, which could reduce affordability. Stocks like State Bank of India and Indiabulls Real Estate might be affected.