Investing vs Trading : Which One is Best for You? 6 Key Insights

When people enter the stock market, they often hear the terms “Investing” and “Trading.” While both involve buying and selling stocks, they follow completely different approaches to making money.

Understanding the difference between investing and trading is crucial for beginners. Some people aim for long-term wealth creation (investing), while others try to make quick profits (trading).

So, which one is right for you? Let’s explore both in detail.

Imagine you have ₹1 lakh. Now, you have two choices:

1. Invest it in a strong company like TCS and hold for 10 years.

2️. Trade daily, buying and selling stocks for quick profit.

This is the fundamental difference between investing and trading. Both have their own benefits and risks, but choosing the right one depends on your financial goals, risk tolerance, and time commitment.

Which one will make you more money? 🤔

By the end of this blog, you’ll know which one suits YOU best! 🚀

Topics Covered

1. What is Investing?

Buy **stocks, mutual funds, and assets**.

**Stay invested for 5-20+ years**.

**Stock prices rise over time**.

**Profit from capital gains & dividends**.

**Like a mango tree, enjoy long-term benefits**.

Investing means buying stocks, mutual funds, or other assets and holding them for years or even decades to grow wealth. Investors look for strong companies with solid fundamentals and steady long-term growth.

💡 Think of investing like planting a mango tree 🌱

You plant a seed today, water it regularly, and wait patiently for it to grow. Once it matures, you enjoy delicious mangoes every year! 🍋🍀

✅ Key Features of Investing:

✔ Long-term approach (5-20+ years)

✔ Focus on company fundamentals 🏢

✔ Lower risk due to diversification 🔄

✔ Profits from capital appreciation & dividends 💰

📌 Example:

Rahul buys 100 shares of TCS and holds them for 10 years. As TCS grows, his investment value increases.

2. What is Trading?

🔍 Identify Trends

Spot stocks with high growth potential.

📊 Chart Analysis

Use indicators & price action strategies.

💹 Buy Entry

Enter trades based on strong signals.

⏳ Monitor Market

Track price action & market news.

📈 Sell for Profit

Exit at the right time to maximize gains.

Trading is about buying and selling stocks frequently to make profits in a short time. Traders don’t focus on company fundamentals but instead use price movements, charts, and patterns to decide when to buy or sell.

💡 Think of trading like a cricket match 🏏

In T20 cricket, players score fast and take quick risks to win in a short time. In the same way, traders buy and sell stocks quickly to make quick profits!

✅ Key Features of Trading:

✔ Short-term approach (minutes to months)

✔ Uses technical analysis & price charts 📈

✔ High-risk but potential for quick profits ⚡

✔ Profits from small price movements 💸

📌 Example:

Amit buys 100 shares of Reliance at ₹2500 in the morning and sells them at ₹2550 in the evening, making a ₹5000 profit in one day.

3. Key Differences: Investing vs Trading

| Feature | 📈 Investing | ⚡ Trading |

|---|---|---|

| ⏳ Timeframe | Long-term (Years/Decades) | Short-term (Minutes to Months) |

| 📊 Focus | Business Growth & Fundamentals | Stock Price Movements |

| ⚠️ Risk Level | Low to Medium | High |

| 💰 Profit Source | Dividends & Capital Appreciation | Short-term Price Changes |

| 🔍 Analysis Type | Fundamental Analysis | Technical Analysis |

| 📌 Strategy | Buy & Hold | Buy & Sell Quickly |

| 📉 Market Volatility Impact | Less Affected | Highly Affected |

| 📌 **Key Takeaway:** Investors focus on steady long-term growth, while traders seek quick profits from market fluctuations. | ||

4. Pros & Cons of Investing vs Trading

✅ Pros of Investing

- ✔ Wealth grows over time 📈

- ✔ Less stress & low maintenance

- ✔ Lower tax on long-term gains

❌ Cons of Investing

- ❌ Returns take time (requires patience) ⏳

✅ Pros of Trading

- ✔ Can make quick profits 💰

- ✔ Earn money in rising & falling markets

❌ Cons of Trading

- ❌ High risk due to market volatility

- ❌ Requires full-time attention & skill

📌 Final Thought

Investing is best for long-term stability, trading is for quick profits but higher risk.

5. Which One Should You Choose?

| If You Want... | Choose |

|---|---|

| Steady, long-term wealth | ✅ Investing |

| Quick short-term profits | ⚡ Trading |

| Less time monitoring markets | ✅ Investing |

| Full-time market involvement | ⚡ Trading |

| 📌 Final Tip: If you're a beginner, start with investing. Trading requires experience, market knowledge, and risk management skills. | |

6. Common Mistakes to Avoid

🚫 Investing Mistakes:

❌ Panic selling during market crashes

❌ Not diversifying investments

❌ Following stock tips blindly

🚫 Trading Mistakes:

❌ Overtrading without a strategy

❌ Ignoring risk management

❌ Trading based on emotions

📌 Solution: Always learn, plan, and manage risks carefully.

7. Expert Tips for Success

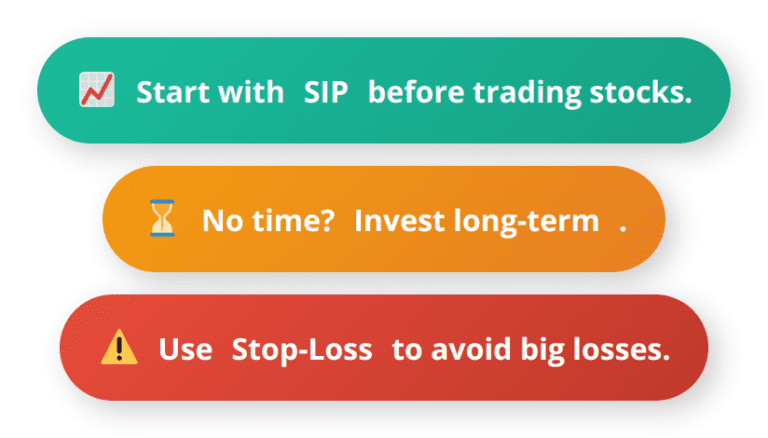

🔹 Tip 1: “If you’re a beginner, start with SIPs in mutual funds before trading stocks.”

🔹 Tip 2: “If you don’t have time for the market daily, long-term investing is best.”

🔹 Tip 3: “Traders should always use stop-loss orders to prevent major losses.”

8. Conclusion

✔ Investing is for long-term wealth creation.

✔ Trading is for short-term profits but has higher risks.

✔ Beginners should start with investing before trying trading.

💡 Final Thought: Choose a strategy based on your financial goals, risk tolerance, and time commitment.

9. Disclaimer

The information in this blog is for educational purposes only. Stock names and financial data are based on current trends and do not constitute investment advice.

📌 Stock market investments involve risks, and actual performance may vary.

📌 Always consult a certified financial advisor before making investment decisions.

This blog does not provide personalized investment advice. Investors should conduct their own research before investing.

✅ Liked this article? Share it with your friends!

Do you invest in stocks? Let us know your experience in the comments below! 🚀

10. Frequently Asked Questions (FAQs)

. Can I do both investing and trading?

Yes, many professionals do both. You can invest 80% for long-term growth and trade 20% for short-term gains.

Which is more profitable: investing or trading?

It depends on your skills and risk tolerance. Trading gives quick profits, but investing builds wealth steadily.

Is trading better than investing in India?

No, both have their own advantages. Trading offers quick profits but is risky, while investing builds steady wealth over time. If you are a beginner, investing is safer than trading.

How much money do I need to start investing or trading?

- Investing: You can start with as little as ₹500 in mutual funds or ₹1000 in stocks.

- Trading: Requires at least ₹10,000 – ₹50,000 for short-term profits.

Can I do trading while working a full-time job?

Yes, you can trade using Algo Trading (Automated Trading). It allows you to set predefined rules, and trades are executed automatically without manual monitoring.

💡 Example: You can set an algo to buy Reliance shares at ₹1300 and sell at ₹1350, and the system will do it automatically.

📌 Popular Algo Trading Platforms in India: Zerodha Streak, TradeTron, Alice Blue ANT.

🚀 This helps professionals trade passively while focusing on their jobs!

. What is the best way to learn investing or trading?

- Start with investing in blue-chip stocks & mutual funds.