How to Read Annual Reports of a Company

Have you ever skipped reading a company’s annual report because it looked like a 200-page financial jungle? 📄😵

You’re not alone!

But here’s the truth:

The annual report is a gold mine of insights into a company’s business, health, growth, and future strategy.

Smart investors like Rakesh Jhunjhunwala, Warren Buffett, and even mutual fund managers depend heavily on it before making big investment decisions.

In this blog, you’ll learn: ✅ What is an annual report?

✅ Why is it important for stock investors?

✅ How to decode each section (simplified for beginners)

✅ What red flags to look for

✅ Real Indian company examples

✅ FAQs, tools, and bonus tips

💡 After reading this, you’ll never fear a company’s annual report again. You’ll enjoy analyzing it! 🚀

Topics Covered:

1. What is an Annual Report?

An Annual Report is a formal document published by a company every financial year. It provides shareholders and investors with key details such as:

- The company’s business performance

- Financial statements (Profit & Loss, Balance Sheet, Cash Flow)

- Management commentary

- Future outlook

- CSR, ESG, and governance practices

Think of it as a health check-up report of the company 🏥.

2. Why Should Investors Read Annual Reports?

Here’s why annual reports are a goldmine for investors:

✅ You get authentic, audited financial data

✅ Understand the company vision, expansion, and risks

✅ Spot consistent performers and fraud risks

✅ Get a complete overview without relying on stock tips

💡 Real-Life Hook: If you’re investing ₹1 lakh in a stock, isn’t it worth spending 20 minutes reading its report?

3. Key Sections of an Annual Report.

🧠 Chairman’s Letter / MD&A

Overview of the year, challenges faced, and management vision.

🏢 Business Overview

Explains what the company does, and in which sectors and regions it operates.

📊 Financial Statements

P&L, Balance Sheet & Cash Flow — key indicators of company performance.

📌 Notes to Accounts

Hidden details: one-time profits/losses, debt info, policy changes.

⚠️ Risk Factors & Auditor Remarks

Lists major risks, red flags & auditor's opinion on financials.

👥 Corporate Governance

Explains board structure, independence, and fair practices.

🌱 ESG / CSR Report

Company’s responsibility toward environment, society, and sustainability.

An annual report can look confusing at first, but don’t worry — you don’t need to read all 200 pages!

Here are the most important sections you should focus on, along with what to look for:

🧩 a) Chairman’s Letter / MD&A (Management Discussion & Analysis)

- This section is written by the company’s top management.

- It gives a summary of the entire year — what went well, what problems they faced, and their plans for the future.

- You’ll also find management’s views on the industry trends, competition, and government policies affecting the business.

📌 Tip: Pay attention to whether the tone is honest or overly positive — that can tell you how transparent the management is.

🧩 b) Business Overview

- This section explains what the company does, which products or services it sells, and in which markets it operates (India or international).

- It tells you about different business segments, like IT services, retail, or pharma, depending on the company.

📌 Tip: If you don’t understand what the company does, don’t invest. Only invest in businesses you understand (Warren Buffett’s advice).

🧩 c) Financial Statements

These are the heart of the annual report. There are 3 main financial reports:

- Profit & Loss Statement (P&L) – Shows the company’s income and profit.

- Balance Sheet – Shows what the company owns (assets) and owes (liabilities).

- Cash Flow Statement – Shows how much real cash came in and went out during the year.

Don’t worry, we’ll explain each one in the next heading 👇

🧩 d) Notes to Accounts

- These are small notes or explanations written below the financial statements.

- They tell you hidden details like:

- How much debt the company took

- One-time losses or profits

- Changes in accounting rules

📌 Tip: Always read the footnotes — they often reveal what the numbers alone don’t tell you.

🧩 e) Risk Factors & Auditor Remarks

- The company lists all the major risks — like raw material price changes, currency fluctuation, legal disputes, etc.

- Auditor’s report confirms if the financials are fair or if there are any concerns (called qualified remarks).

📌 Red Flag: If the auditor says something like “subject to…”, “cannot verify…”, it means something fishy might be going on.

🧩 f) Corporate Governance Report

- Tells how the company is being run and managed.

- Includes info about board meetings, independent directors, and if the company follows fair practices.

📌 Why it matters: Good governance = investor-friendly company.

🧩 g) ESG/CSR Report (Environment, Social, Governance & CSR Activities)

- Shows how responsible the company is towards society, employees, and the environment.

- CSR spending, climate policies, and sustainability initiatives are usually mentioned here.

4. How to Read Financial Statements in the Annual Report

Let’s dive deeper into the 3 most important sections inside every annual report. You don’t need to be an accountant — just focus on the key numbers and trends 👇

📌 Profit & Loss Statement (P&L)

Also called the Income Statement. It shows earnings and expenses over the year.

- Revenue / Sales: Is it growing year-on-year?

- EBITDA: Profit from core business.

- Net Profit: After all expenses.

- EPS: Profit per share.

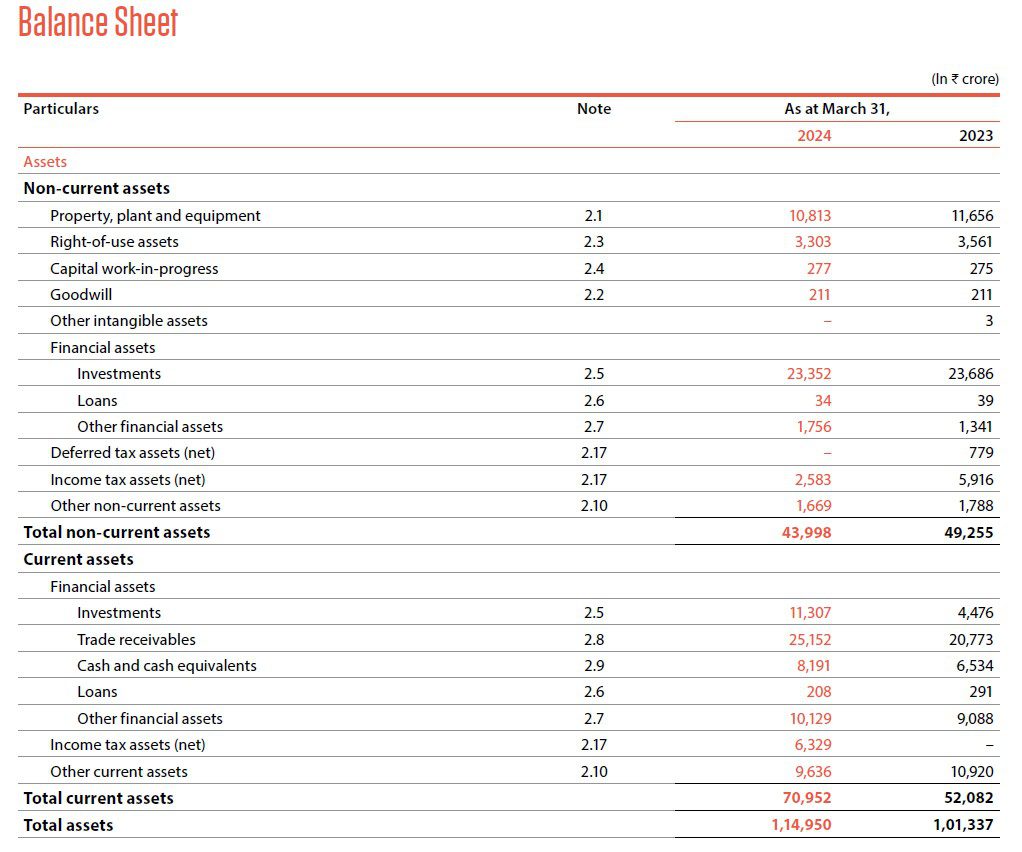

📌 Balance Sheet

Snapshot of assets (what the company owns) and liabilities (what it owes).

- Assets: Land, cash, receivables.

- Liabilities: Loans, interest payments.

- Net Worth: Assets minus liabilities.

📌 Cash Flow Statement

Tracks how much real cash came in and went out during the year.

- Operating: From core business.

- Investing: Buying/selling assets.

- Financing: Loans, shares, dividends.

Now let’s go deeper into the three important financial section inside every annual report. You don’t need to be an accountant — just focus on key numbers:

📌 a) Profit & Loss Statement (P&L)

This is also called the Income Statement. It shows the company’s earnings and expenses over the year.

Key Things to Check:

- Revenue / Sales: Is it growing year-on-year?

- EBITDA (Operating Profit): Profit from core business (before taxes and interest).

- Net Profit: Final profit after all expenses.

- EPS (Earnings Per Share): Net profit divided by number of shares — shows how much profit each share earned.

📌 Green Signal: Sales and net profit should grow steadily over the years.

📌 b) Balance Sheet

This gives you a snapshot of what the company owns (assets) and what it owes (liabilities) at the end of the year.

Key Things to Check:

- Assets: Land, machinery, cash, receivables.

- Liabilities: Loans, outstanding bills, interest payments.

- Net Worth / Shareholder Equity: Total assets minus total liabilities.

📌 Red Flag: If the company has more debt than assets, be careful. Look for low debt-to-equity ratio.

📌 c) Cash Flow Statement

This tells you how much actual cash came in and went out. Sometimes, a company shows profit on paper but has no cash in hand.

Divided into 3 parts:

- Cash Flow from Operating Activities: Cash from the main business.

- Cash Flow from Investing Activities: Cash used for buying/selling assets.

- Cash Flow from Financing Activities: Cash from loans, share issues, dividends, etc.

Key Metric:

- Positive Operating Cash Flow is a must. If it’s negative for many years, it’s a warning sign.

📌 Green Signal: Profitable companies with strong cash flows are financially healthy.

Confused between investing and trading? Don’t worry—this article will clear your doubts:

📖 Investing vs Trading: Which One is Best for You?

5. What to Watch Out For (Red Flags)

🚩 Sudden drop in revenue or margin

🚩 Debt increasing faster than revenue

🚩 Promoters pledging shares

🚩 Huge rise in receivables (money not yet received)

🚩 Negative cash flows for multiple years

🚩 Frequent change of auditors

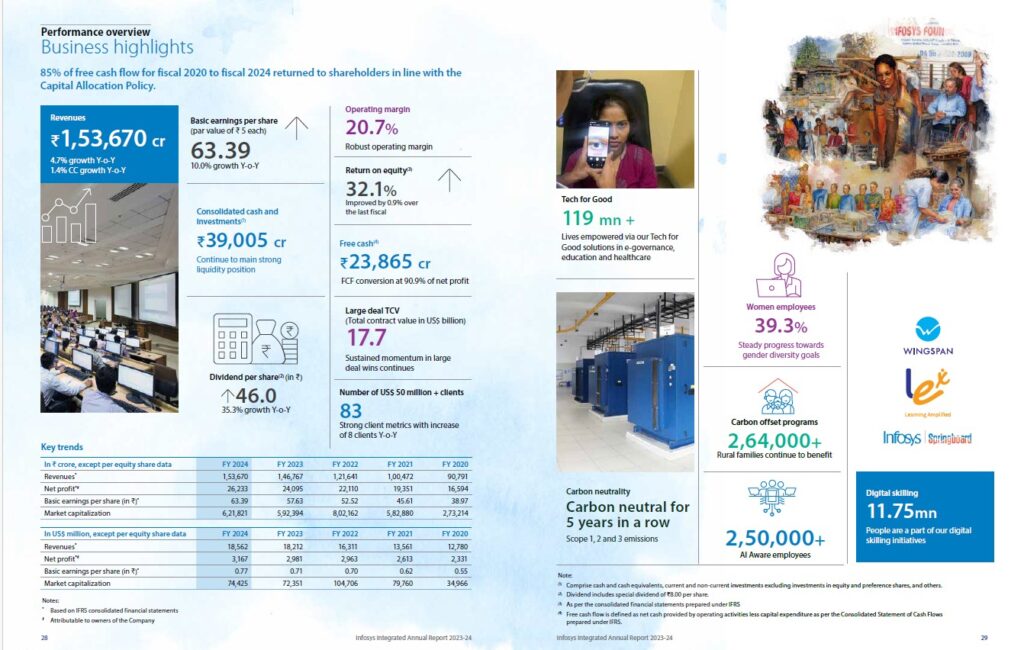

6. Real-Life Example: Infosys Annual Report Breakdown

Let’s break down the process for reading and analyzing the Infosys Annual Report 2023-24 in simple steps:

✅ Step-by-Step Guide

🔍 Step 1: Search the Company on Screener.in

- Go to 👉 screener.in

- Type “Infosys” in the search bar.

- Click on the company name in the search results.

📥 Step 2: Download the Annual Report

- On Infosys’s Screener page, scroll down to the “Annual Reports” section.

- Click the PDF link for the latest year (e.g., Financial Year 2024) to download the report.

📄 You now have access to the company’s full report!

🔎 Step 3: Focus on These Key Sections (With Page Numbers)

You can search for these section names inside the PDF. For better clarity and navigation, also refer to the Table of Contents at the beginning of the report to quickly jump to specific sections.

| 📂 Section | 📘 Name in Report | 📄 Page No. | 🔍 Why It’s Important |

|---|---|---|---|

| 🧠 Chairman’s Letter | Letter to the Shareholder | 32–33 | Gives company vision and key priorities |

| 💬 Management’s View | Management Discussion & Analysis (MD&A) | 96–105 | Shows strategy, sector outlook, and challenges |

| 📊 Financials | Standalone & Consolidated Financials | 204–299 | Includes P&L, Balance Sheet, Cash Flow |

| 🧾 Auditor’s Notes | Standalone Auditor’s Report | 208 | Confirms if financials are clean or risky |

| ⚠️ Risk Factors | Risk Management Report | 147 | Shows risks, liabilities, or red flags |

| 💡 CSR & ESG | CSR / BRSR Report | 152–202 | Company’s ethical & social responsibility |

| 📋 Notes to Accounts | After Financial Statements | 220+ | Breakdown of hidden info & key figures |

📘 What You’ll Learn from Infosys FY24 Report:

| 📊 Metric | 📈 Highlight |

|---|---|

| 🏆 Revenue | ₹1,53,670 Cr (up from ₹1,46,767 Cr) |

| 💰 Net Profit | ₹26,233 Cr |

| 💼 Free Cash Flow | ₹23,865 Cr |

| ✅ Debt | Zero debt (excellent financial health) |

| 👨💼 Promoter Holding | Strong & stable |

| 📢 Dividend | ₹46 per share |

| 📌 Verdict: Infosys has high cash reserves, zero debt, strong profitability, and a clean audit report — a sign of long-term consistency and investor trust. | |

7. Tools & Websites to Access & Analyze Annual Reports

8. How to Use Annual Reports for Investment Decisions

✅ Compare 5-year data (sales, profit, margins)

✅ Read MD&A to understand management vision

✅ Check consistency in dividend and cash flows

✅ Understand sector impact (raw material prices, govt. policies)

✅ Review auditors’ remarks & debt levels

📈 Bonus Tip: Look for companies with high ROE, low debt, and clean corporate governance.

Want to take your stock research even further? Discover how top investors find winning stocks using free tools and smart filters.

👉 Read: How to Find the Best Stocks to Beat the Market

9. Common Mistakes to Avoid

🚫 Only reading the first 3 pages and skipping financials

🚫 Ignoring notes to accounts

🚫 Blindly trusting auditor remarks

🚫 Not comparing with peers or previous years

🚫 Investing just based on net profit without checking cash flow

10. Conclusion

Reading annual reports might seem overwhelming, but once you get used to them, they become the most reliable tool in your investment journey.

✔ No more guessing

✔ No more depending on random YouTube tips

✔ You will understand where your money is going and why

💡 Final Thought: “An investor who reads annual reports is smarter than 90% of traders chasing tips.”

Are you already read annual reports? or you will start reading from now? Comment below!

11. Disclaimer

The information in this blog is for educational purposes only. Stock names and financial data are based on current trends and do not constitute investment advice.

📌 Stock market investments involve risks, and actual performance may vary.

📌 Always consult a certified financial advisor before making investment decisions.

This blog does not provide personalized investment advice. Investors should conduct their own research before investing.

✅ Liked this article? Share it with your friends!

Do you invest in stocks? Let us know your experience in the comments below! 🚀

12. FAQs

Where can I find annual reports of Indian companies?

You can find them on NSE, BSE, company websites (under Investor Relations), and financial portals like Screener.in and Moneycontrol.

How long does it take to read an annual report?

Beginners may take up to 45–60 minutes initially. With practice, focusing on key sections takes just 15–20 minutes.

Can beginners understand annual reports without a finance background?

Yes! By focusing on key areas like revenue, profit, debt, and cash flow, even non-finance users can understand the basics.

What should I avoid while reading an annual report?

Avoid focusing only on profits. Always check debt, cash flow, and auditor remarks for a complete financial picture.

Should I read the report every year for the same company?

Yes. Annual reviews help track changes in business, risks, and future plans — especially through the MD&A section.