Common Challenges Faced by Retail Investors and How to Overcome Them

Think stock market success is just about buying low and selling high? If only it were that simple! So why do so many retail investors enter the market with big dreams—only to face losses, panic, and regret?

If you’ve ever:

📉 Bought a stock at its peak, only to watch it crash the next day…

🫤 Followed WhatsApp & Telegram stock tips—and lost money…

🤯 Felt stuck watching others profit while your portfolio bleeds…

You’re not alone. The stock market isn’t unfair, but without the right knowledge, retail investors fall into common traps—panic selling, chasing quick gains, and investing blindly.

By the end of this blog, you’ll know:

✅ Biggest mistakes retail investors make (and how to avoid them)

✅ How to stop emotional investing & bad stock decisions

✅ Smart strategies to protect & grow your money

✅ Must-use tools for better stock research

Let’s fix these mistakes and invest smarter! 🚀

Topics Covered

1.Who Are Retail Investors?

A retail investor is an individual who invests their personal money in stocks, mutual funds, or other assets. Unlike institutional investors (mutual funds, hedge funds, or big companies), retail investors usually have:

✅ Limited capital to invest

✅ Less access to expert financial research

✅ Higher emotional influence on decisions

🔹 Examples of Retail Investors in India

👨💼 Salaried employee: Investing ₹5,000 per month in stocks

👩💻 College student: Learning trading with small capital

🏢 Small business owner: Buying shares of blue-chip companies

👉 New to investing? It’s important to know who really moves the market. Don’t miss this eye-opening article 4 Big Players Who Control the Indian Stock Market.

2. Common Challenges Faced by Retail Investors

Retail investors often repeat the same mistakes that prevent them from making consistent profits. Below are the biggest obstacles and smart ways to solve them.

Blindly follow stock tips without understanding

✅ Learn from SEBI, NSE, BSE sources & books

Fear during market crash, greed at market highs

✅ Focus on long-term investing, avoid panic selling

Trading in F&O without proper knowledge

✅ Build wealth slowly with quality companies

Random investments without goal

✅ Define clear goals & choose your investment style

Relying on Telegram, WhatsApp, YouTube advice

✅ Cross-check with SEBI advisors & do your own research

Putting all money in a single risky stock

✅ Diversify across sectors, stocks, and ETFs

1️.Lack of Knowledge & Financial Education

❌ Problem:

Many investors jump into the stock market without understanding how it works. They blindly follow social media stock tips, friends, or news channels instead of doing their own research.

✅ Solution:

✔ Learn from SEBI-certified sources like NSE India & BSE India

✔ Read books like The Intelligent Investor & Common Stocks & Uncommon Profits

✔ Use free tools like Screener.in, Moneycontrol, and TickerTape

📌 Real-Life Example:

Rahul, a software engineer, lost ₹1 lakh following Telegram stock tips. After realizing his mistake, he learned fundamental analysis and now invests only in quality stocks.

👉 New to investing? Start smart. Read this beginner guide:

📖 Stock Market Basics: A Beginner’s Guide

2️.Emotional Investing (Fear & Greed)

❌ Problem:

Retail investors often make decisions based on fear and greed. They panic sell during market crashes and buy stocks at all-time highs due to FOMO (Fear of Missing Out).

✅ Solution:

✔ Stick to long-term investing instead of reacting to daily fluctuations

✔ Set a stop-loss to control risks

✔ Use SIP (Systematic Investment Plan) instead of lump sum investing

📌 Real-Life Example:

During the COVID-19 crash (2020), many investors panic sold their stocks. But those who held onto quality stocks saw their portfolios grow massively in 2021-22.

📖 Bonus Tip:

Want to know how to stay smart during a crash? Read: 👉 How to Invest Smartly During a Market Correction

3️. Lack of Patience & Chasing Quick Profits

❌ Problem:

Many investors expect instant profits and start intraday trading and F&O ( Future and options) without understanding the risks. They frequently switch stocks and fail to hold investments long enough to generate real wealth.

✅ Solution:

✔ Think long-term (5-10 years minimum)

✔ Avoid F&O and day trading unless you have expertise

✔ Invest in fundamentally strong companies with growth potential

📌 Real-Life Example:

If you had invested ₹1 lakh in Reliance Industries in 2013, it would be worth ₹4-5 lakh in 2025. However, if you kept switching stocks, you might have missed these gains.

Confused between investing and trading? Don’t worry—this article will clear your doubts:

📖 Investing vs Trading: Which One is Best for You?

4️. No Clear Investment Strategy

❌ Problem:

Most retail investors invest randomly without a proper strategy. Some follow YouTube influencers, while others buy stocks without research.

✅ Solution:

✔ Choose your investment style (long-term, swing trading, value investing)

✔ Use fundamental and technical analysis for stock selection

✔ Follow a goal-based investment approach (retirement, wealth creation, etc.)

📌 Real-Life Example:

Amit, an IT professional, started investing without a plan. After losing money in penny stocks, he built a diversified portfolio of blue-chip stocks and ETFs, achieving stable returns.

5️. Blindly Following Stock Market Tips & Rumors

❌ Problem:

Many investors rely on WhatsApp groups, Telegram channels, and unverified stock tips instead of conducting proper research.

✅ Solution:

✔ Never invest based on stock tips from random sources

✔ Verify recommendations using SEBI-registered advisors

✔ Analyze a company’s financials, management, and business model

📌 Real-Life Example:

During the Yes Bank crisis (2020), many retail investors bought shares based on tips. However, the stock crashed further, causing huge losses.

6. Over-Investing in One Stock

❌ Problem:

Many investors put all their money into one stock instead of diversifying across sectors. This increases risk if the company fails.

✅ Solution:

✔ Diversify across at least 5-10 stocks from different sectors

✔ Include ETFs and mutual funds for stability

✔ Follow the 80-20 rule: 80% in safe assets, 20% in high-risk stocks

📌 Real-Life Example:

If you had invested all your money in Yes Bank in 2018, you would have faced a 90% loss. But if you diversified into HDFC Bank, ICICI Bank, and SBI, your portfolio would have remained stable.

🔍 Want to build a balanced portfolio? Learn the 6 powerful secrets of investing in Small-Cap, Mid-Cap & Large-Cap Stocks.

3. Practical Tools for Retail Investors

Here are some tools to simplify your investment journey:

4. Conclusion: From Confused to Confident — Your Investing Journey Starts Now

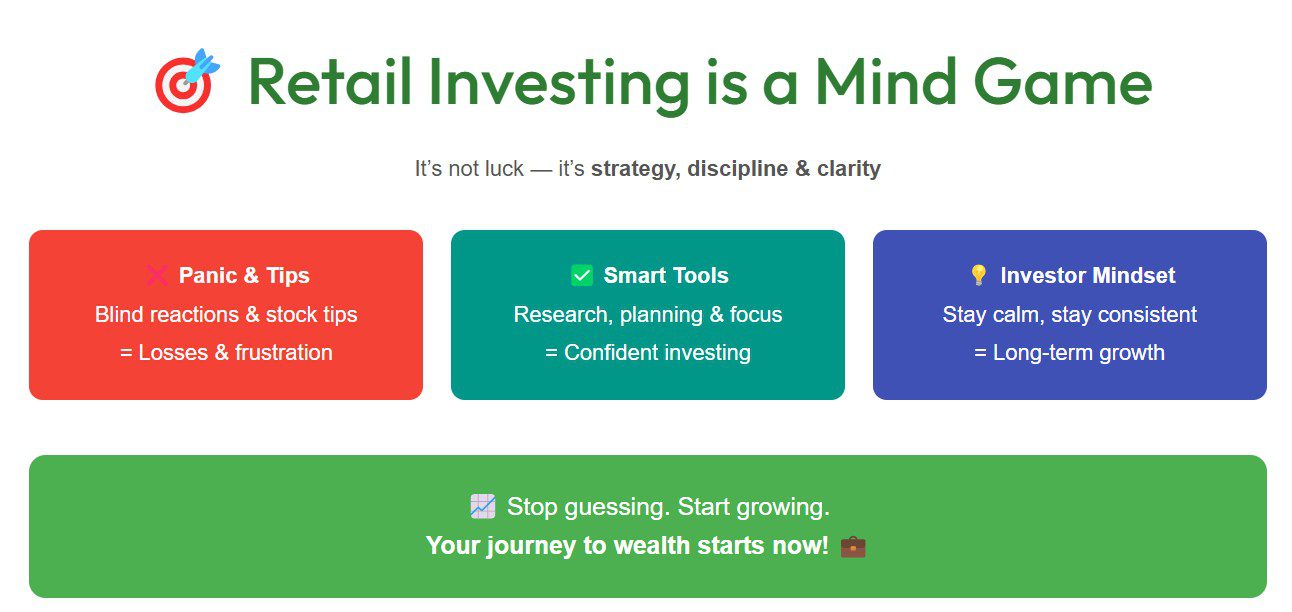

Retail investing isn’t a gamble — it’s a game of strategy, patience, and mindset.

Most people lose not because the market is against them, but because they enter blindly — chasing tips, reacting emotionally, and quitting too soon.

But you’re different now.

You’ve seen the traps.

You’ve learned what works.

You know how to invest smartly — not emotionally.

🚫 No more panic selling.

🚫 No more random stock tips.

✅ Just solid research, smart tools, and consistent action.

The market doesn’t reward noise — it rewards discipline.

So stop guessing. Start growing.

And remember — in the stock market, clarity beats chaos.

Your journey to long-term wealth doesn’t start someday.

It starts now. 💼📈

5. Disclaimer

The information in this blog is for educational purposes only. Stock names and financial data are based on current trends and do not constitute investment advice.

📌 Stock market investments involve risks, and actual performance may vary.

📌 Always consult a certified financial advisor before making investment decisions.

This blog does not provide personalized investment advice. Investors should conduct their own research before investing.

✅ Liked this article? Share it with your friends!

Do you invest in stocks? Let us know your experience in the comments below! 🚀

6. Frequently Asked Questions (FAQs)

How can a beginner start investing in the stock market?

Start by opening a Demat and trading account with a trusted broker like Zerodha, Groww, or Upstox. Begin investing in blue-chip stocks or index funds (like Nifty 50). Use free research tools like Screener.in or NSE India to understand basic financials before buying any stock.

Why do most retail investors lose money?

Because they invest without a plan. Emotional decisions, chasing tips from WhatsApp/Telegram groups, panic selling during crashes, or blindly copying others lead to poor results. Lack of knowledge is the biggest risk in the market.

How much should I invest as a beginner?

Start small — invest ₹5,000 to ₹10,000, or an amount you’re okay losing while learning. Focus on learning first, then gradually increase your investment as you build confidence and knowledge.

What are some safe investment options for beginners?

For low-risk investing, consider ETFs, large-cap mutual funds, and blue-chip stocks. You can also explore government bonds or PPF for stable returns. These options reduce risk while offering steady long-term growth.

How long should I hold stocks to build wealth?

If you’re investing in fundamentally strong companies, hold them for at least 5–10 years. Long-term investing allows you to benefit from compound growth, dividend income, and market cycles — just like seasoned investors do.

What tools or platforms should I use for better stock research?

Use Screener.in to analyze financial ratios and company fundamentals, Trendlyne to track FII/DII activity, and NSE India for real-time data. These tools help you invest based on facts, not emotions.